You have got clicked a backlink to the web site outside of the TurboTax Neighborhood. By clicking "Keep on", you can depart the Local community and be taken to that internet site as a substitute.

Audit Support Ensure – Individual Returns: If you receive an audit letter in the IRS or State Department of Revenue dependant on your 2023 TurboTax unique tax return, We're going to deliver 1-on-1 query-and-answer guidance which has a tax Experienced, if requested by way of our Audit Assist Center, for audited personal returns submitted with TurboTax for The present 2023 tax 12 months and for personal, non-business enterprise returns for that past two tax many years (2022, 2021). Audit support is informational only.

You can email the site operator to let them know you had been blocked. Please consist of Anything you were being accomplishing when this web site came up as well as Cloudflare Ray ID located at The underside of this site.

Use of as much as seven yrs of tax returns We now have on file to suit your needs is available through December 31, 2025. Terms and conditions could vary and they are issue to alter without warning.

You've got clicked a website link to your web-site beyond the TurboTax Community. By clicking "Continue", you may leave the Community and become taken to that internet site alternatively.

The setup wizard will provide move-by-phase instructions. You might require to pick additional attributes or configurations determined by your Tastes. Ensure that you comply with Every move to stop missing vital configurations.

Business Tax Assurance: If you employ TurboTax to file your small business tax return, you'll be covered by a mix of our 100% accurate calculations, maximum price savings and audit assistance assures. Should you pay out an IRS or point out penalty (or interest) because of a TurboTax calculation mistake or an error that a TurboTax skilled manufactured whilst performing for a signed preparer in your return, we'll pay back you the penalty and curiosity. You're chargeable for paying out any additional tax liability you could possibly owe. If you obtain a bigger refund or lesser tax thanks from A different tax preparer by submitting an amended return, we will refund the applicable TurboTax Are living Small business federal and/or condition obtain value compensated.

100% Accurate Calculations Assurance: In the event you spend an IRS or state penalty or desire on account of a TurboTax calculation mistake, we'll shell out you the penalty and desire. You might be chargeable for paying out any additional tax legal responsibility you could owe.

If that is so, try out clearing out your browser's cache and delete the cookies saved on your Computer system. An entire or corrupted cache can preserve TurboTax from operating properly.

More self-employed deductions: depending on the median level of bills discovered by TurboTax Top quality (formerly Self Utilized) clients who synced accounts, imported and classified transactions in here comparison to handbook entry. Individual benefits may possibly fluctuate.

If you add providers, your company fees are going to be altered appropriately. In the event you file soon after eleven:59pm EST, March 31, 2024, you're going to be billed the then-present-day record price for TurboTax Live Assisted Fundamental and state tax filing is an additional charge. See existing charges listed here.

The IRS will maintain your total refund, including any element of your refund not associated with the EITC or ACTC.

TurboTax Reside - Tax Assistance and Professional Critique: Access to an authority for tax thoughts and Specialist Critique (a chance to Possess a tax skilled evaluate) is incorporated with TurboTax Stay Assisted or being an upgrade from An additional TurboTax product or service, and available by means of December 31, 2025. Use of a specialist for tax thoughts is also included with TurboTax Reside Total Provider and readily available as a result of December 31, 2025. If you utilize TurboTax Are living, Intuit will assign you a tax qualified based on availability. Tax professional availability could be restricted. Some tax subjects or circumstances is probably not included as part of the company, which shall be identified for the tax pro's sole discretion. A chance to keep the exact same pro preparer in subsequent yrs might be according to a professional’s choice to carry on employment with Intuit as well as their availability for the periods you decide to prepare your return(s).

Go with a Totally free File solution from . You received’t get the cost-free service should you go on to a corporation’s website.

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Elisabeth Shue Then & Now!

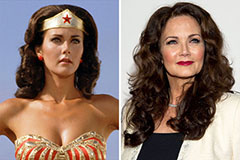

Elisabeth Shue Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!